Key Economic Indicators 2019

Gross Domestic Product GDP

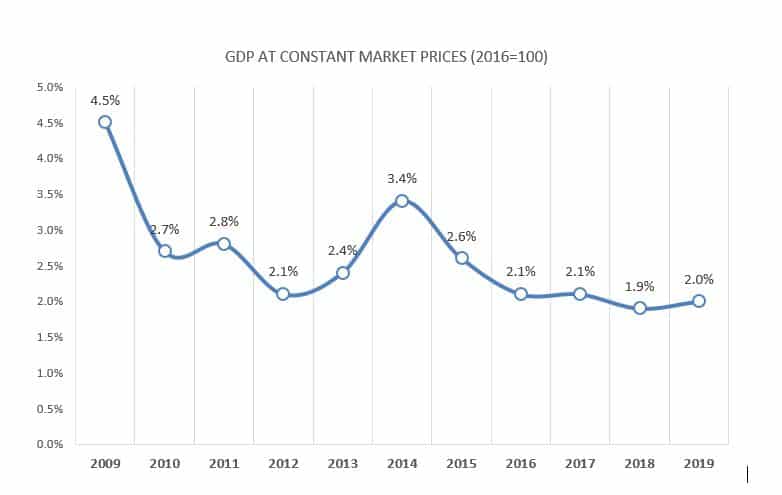

According to the latest figures published by Central Bank of Jordan (CBJ), Gross domestic product (GDP), at constant market prices, recorded a growth of 2.0% during 2019, compared to 1.9% during 2018. The main sectors that contributed to the real economic growth during 2019; (real estate, 0.4 percentage point), (finance and insurance services, 0.3 percentage point), (transport and communications, 0.3 percentage point), (producers of government services, 0.3 percentage point), (manufacturing, 0.2 percentage point), and (social and personal services, 0.2 percentage point). These sectors collectively accounted for 85.0 percent of real GDP growth rate during 2019.

According to the latest figures published by Central Bank of Jordan (CBJ), Gross domestic product (GDP), at constant market prices, recorded a growth of 2.0% during 2019, compared to 1.9% during 2018. The main sectors that contributed to the real economic growth during 2019; (real estate, 0.4 percentage point), (finance and insurance services, 0.3 percentage point), (transport and communications, 0.3 percentage point), (producers of government services, 0.3 percentage point), (manufacturing, 0.2 percentage point), and (social and personal services, 0.2 percentage point). These sectors collectively accounted for 85.0 percent of real GDP growth rate during 2019.

Microeconomic Indicators

The microeconomic indicators of the available period displayed a divergent performance. Some indicators recorded a growth, such as; (production of phosphate, 2.2 percent). However, other indicators showed a contraction, particularly; (number of departures, 40.5 percent), (value traded at the real estate market, 16.1 percent) and (manufacturing production quantity index, 15.1 percent).

Prices

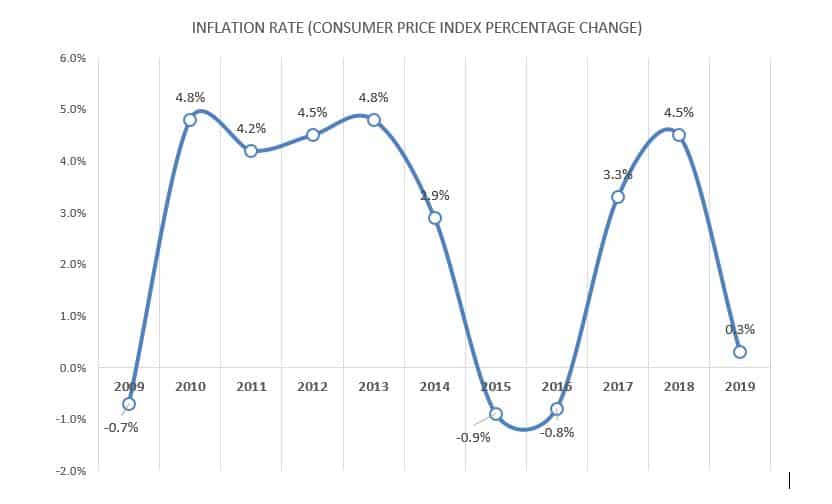

The general price level, measured by the percentage change in CPI, increased by 0.3 percent during 2019, compared to a rise of 4.5 percent during 2018. The drop in inflation occurred as the impact of price and tax measures taken by the government in early 2018 faded out, as well as the drop in oil prices in the international markets.

The Labor Market

The unemployment rate reached 19.0 percent during 2019, compared to 18.6 percent during 2018.

Interest Rates on Monetary Policy Instruments

During 2019, the CBJ lowered interest rates on its monetary policy instruments by 75 basis points (25 basis points in August, 25 basis points in September and another 25 basis points in October) to become as follows: The CBJ main interest rate: 4.00 percent. Re-Discount Rate: 5.00 percent. Interest Rate on Repurchase Agreements: 4.75 percent. Overnight Deposit Window Rate: 3.25 percent. This decision comes in response to the recent developments in the interest rates in the regional and international markets and supported by the comfortable level of foreign exchange reserves held by the CBJ. Moreover, the decision aims to catalyze the growth of credit facilities extended to various economic sectors and promote domestic spending, at both consumption and investment levels, which will positively stimulate the economic growth.

Credit Facilities Extended by Licensed Banks and Deposits

Total credit facilities extended by licensed banks stood at JD 27,082.2 million by the end of 2019, recording an increase of JD 970.4 million, or 3.7 percent, compared to its level at the end of 2018, which witnessed an increase of JD 1,375.0 million, or 5.6 percent, compared to 2017.

Total deposits at licensed banks stood at JD 35,305.3 million at the end of 2019, increasing by JD 1,457.2 million, or 4.3 percent, compared to its level at the end of 2018.

The performance of the general budget

Public revenues dropped by JD 85.3 million in 2019, or 1.1 percent, compared to 2018 to stand at JD 7,754.3 million. This came as a result of the increase in domestic revenues by JD 21 million, and a decline in foreign grants by JD 106.3 million.

Public expenditures increased by JD 245.4 million, or 2.9 percent, during 2019 to stand at JD 8,812.7 million. This increase was an outcome of the rise in current expenditures by 3.6 percent, and the decrease in capital expenditures by 3.4 percent.

The general budget, including foreign grants, registered an overall fiscal deficit of JD 1,058.4 million during 2019, an increase of JD 330.8 million, compared to a fiscal deficit of JD 727.6 million during 2018. As a percent of GDP, the budget deficit reached 3.3 percent compared to 2.4 percent in 2018. When foreign grants are excluded, the general budget deficit widens to reach JD 1,846.8 million (5.8 percent of GDP) during 2019, compared to a fiscal deficit of JD 1,622.3 million (5.3 percent of GDP) in 2018.

Public Debt

Gross outstanding domestic public debt increased by JD 1,517 million, at the end of 2019 compared to its level at the end of 2018, to stand at JD 17,738 million (56.9 percent of GDP compared to 54.1 percent of GDP at the end of 2018).

The balance of the external public debt (budget and guaranteed) went up by JD 250.7 million at the end of 2019, compared to its level at the end of 2018, to reach JD 12,338.2 million (39.6 percent of GDP compared to 40.3 percent of GDP at the end of 2018). In light of the above-mentioned developments, gross public debt (domestic and external) increased by JD 1,767.9 million at the end of 2019 to stand at JD 30,076.2 million (96.6 percent of GDP), compared to JD 28,308.3 million (94.4 percent of GDP) at the end of 2018.

CBJ’s Foreign Reserves

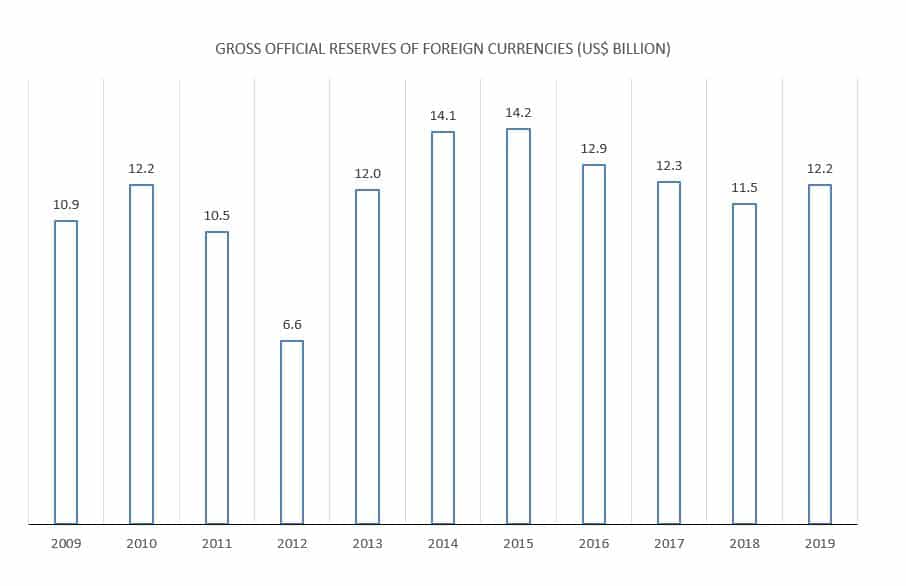

The CBJ’s gross foreign reserves (including gold and SDRs) amounted to US$ 14,329.3 million at the end of 2019. This level of reserves covers around 7.7 months of the kingdom’s imports of goods and services. Gross official reserves of foreign currencies, however, was recorded at US$ 12,170.4 million by the end of 2019, an increase of 5.6% over 2018.

Trade Balance

The trade balance deficit registered JD 7,826.9 million at the end of 2019, a decrease of 12.3 percent compared to 2018. This decrease resulted from an increase in total exports by JD 7.3 percent, standing at JD 5,902.2 million and a decline in imports by 4.8 percent to stand at JD 13,729.1 million.

Workers’ Remittances Receipts & Travel Receipts

Total workers’ remittances receipts decreased by 0.9 percent compared to 2018 to reach JD 2,629.7 million, while travel receipts increased by 10.2 percent compared to 2018 to reach JD 4,108.2 million.