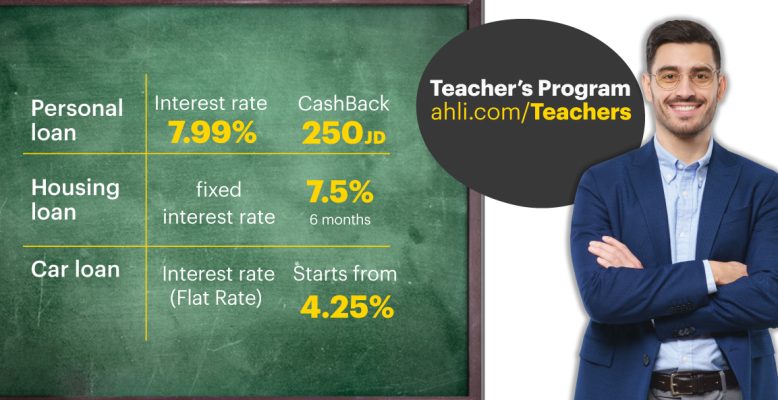

Jordan Ahli Bank is always keen to provide financial solutions that align with the financial needs and future aspirations of its customers. Based on this, we have launched our Teachers Program, which aims to provide financial solutions that contribute to supporting and empowering teachers to achieve their personal and professional goals with facilitated terms, competitive interest rates, and a flexible repayment period.

Terms and Conditions:

Real Estate Loans:

- This campaign is valid until 30/06/2024.

- Possibility to transfer your loans, not exceeding 100% of the appraised value, and at a fixed interest rate of 7.5% for 6 months After the installation period, pricing is determined based on the interbank rate as of that date, plus a fixed margin of 3.5%.

- Fixed Competitive interest rate of 7.5% for 6 months After the installation period, pricing is determined based on the interbank rate as of that date, plus a fixed margin of 3.5%.

- The bank covers mortgage and appraisal fees without granting any commission.

- Minimum loan amount is 15,000 Jordanian Dinars.

Car Loans:

- undetermined duration, and the customers will be informed upon suspension.

- Loan features depend on the car category as follows:

- Categories:

- Category A: Preowned, Certified cars with a maximum age of 3 years at the time of granting (excluding cars manufactured in China).

- Category B: All types of cars with an age between 3-7 years at the time of granting (excluding cars manufactured in China).

- Category C: All cars, including Chinese cars, with zero mileage, and an age exceeding 7 years at the time of granting.

- Fixed interest rate starting from 4.25% for financing less than 50% and 4.5% for financing over 50%.

- If financing an electric car, the bank pays the customers electricity bill with a monthly amount of 25 Jordanian dinars for one year.

- If financing a hybrid car, the client receives a 100 Jordanian dinar gasoline voucher once.

- Life insurance is provided within the bank’s policy, noting that the bank’s grant procedures require insurance for the contract guarantees, the borrower’s life, and cases of permanent total disability that may occur in the future.

- Mortgage fees are covered by the bank.

- DBR is based on bank policy.

- A pre-approved credit card is granted for customer, representing 10% of the car value, with a maximum of 5,000 Jordanian dinars.

- The loan can be granted to customers under program conditions, and the car can be registered under the name of another non-working person (son, spouse, father, mother, brother, sister), with the non-working person considered an additional guarantee on the loan.

- No need for a certified appraiser if the car is directly from the dealer or new Certified cars; only a price quote is required.

- Financing more than one car is possible for the same client, within the debt burden limits, with a maximum of two car loans and three loans for exclusive customers.

- The minimum loan amount is 5,000 Jordanian dinars.

- The maximum loan amount is 100,000 Jordanian dinars for new cars and 75,000 Jordanian dinars for used cars.

- The minimum repayment period is 12 months.

- The car’s age must not exceed 15 years at the end of the loan term.

- An additional 5% burden is granted to clients for electric cars only, if it is proven that the reason for financing is to replace the current gasoline car.

- Salary transfer is not required for car loans within the “Salaries” segment.

Personal Loans:

- undetermined duration, and the customers will be informed upon suspension.

- Direct cashback 250 JD

- Interest rate of 7.99%

- Fixed interest rate for one year, then the rate determined based on interbank with 4.5% fixed margin.

- The minimum amount for a personal loan is 5,000 Jordanian dinars.

General Provisions:

- Administrative employees within the Ministry of Education are granted a pre-approved credit card with a limit of 1,000 Jordanian dinars for a salary of 500 Jordanian dinars or more.

- An additional 5% debit burden for teachers of “Mathematics, Physics, Chemistry, English”, in condition that DBR does not exceed the approved DBR policy by the bank, which determined the acceptable DBR as below:

(50%) without credit card (55%) with credit card | The maximum acceptable DBR for the customer as a debtor for salaries/income less than (1,000) dinars. |

(55%) without credit card (60%) with credit card | The maximum acceptable DBR for the customer as a debtor for salaries/income more than (1,000) dinars. |